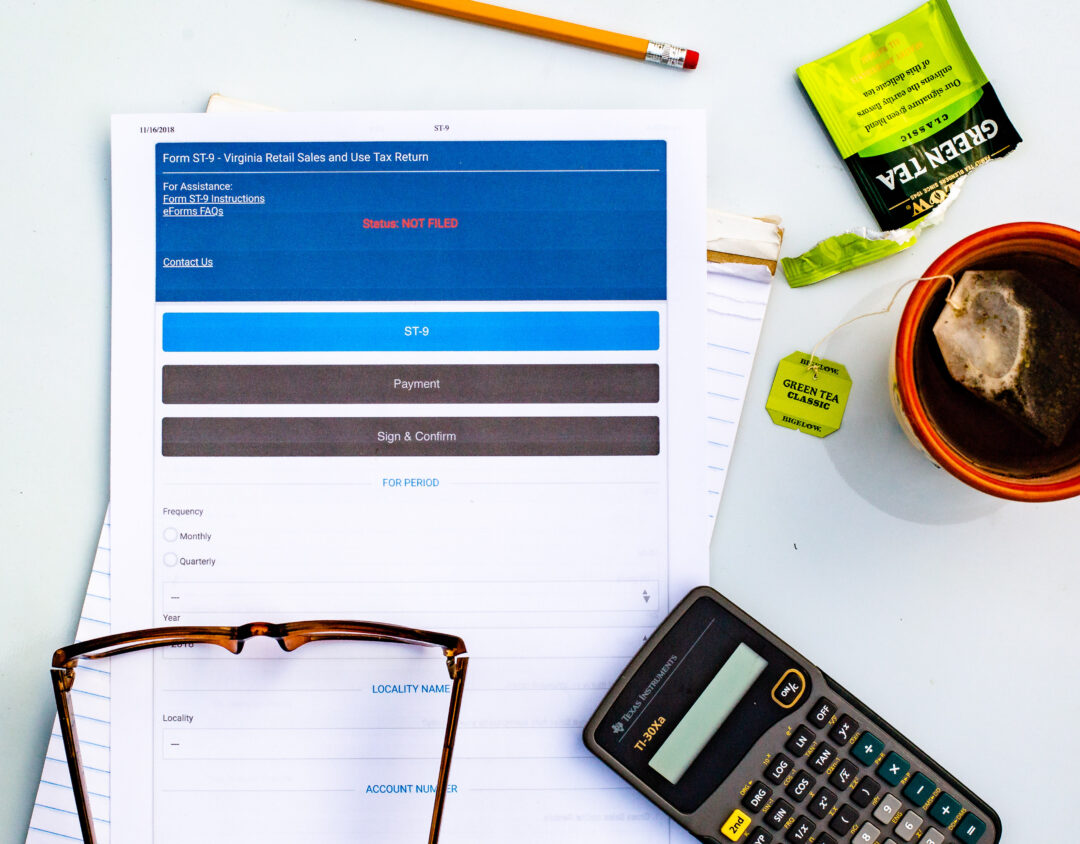

Tax time is here again

Tax time is here again. Pamela Kay Photography, LLC is in its third year of business. Finalizing taxes with my CPA is a huge relief for me this year. Running a photography business is about creatively expressing yourself through your work. It is about doing what you love.

Profit and loss in any business is very important. Accounting is a very important aspect of your business. Every photography LLC needs a Certified Public Accountant (CPA) — or just accountant. Are you running a business and stressed about taxes this year? I have put together five reasons your photography LLC needs a CPA.

CPAs allow you to focus on the business of photography

A CPA allows you, the photographer, to focus on the business of photography and making money doing what you love. Running a photography business requires a very diverse set of skills. If accounting is not something you want to be spending late nights working on, a CPA can expertly help you. You will have more opportunity to focus on updating your blog, styling photography shoots, catching up on your reading or simply more time to focus on your customers.

CPAs ensure LLC taxes are completed on time

CPAs live for tax season. It is their bread and butter. This is how they make a living. CPAs love their work and should be good with the details. A CPA will ensure your taxes are completed on time. Photographers typically put off accounting and bookkeeping tasks. Keeping up with taxes is necessary to a thriving business. Ensure your taxes are completed on time and hire a CPA. CPAs focus on doing taxes correctly. You get to avoid hours and hours studying complicated tax laws each year.

CPAs follow tax laws

CPAs will ensure you follow the tax laws. Every state has different rules regarding business taxes. These rules change with very little notice. They can be complicated and difficult to read and understand. Your CPA is dedicated to knowing what the laws are in your state and ensuring taxes are filed correctly.

CPAs provide expert tax advice

One of the best things about hiring a CPA is that you have someone you trust to call for general questions or expert tax advice. Liking your CPA is important because this is someone you want to trust. You will be meeting with them throughout the year. Your CPA is the person who will give you simple answers to complex questions. Your CPA is the expert in an area where you are grateful to have the help. Getting expert tax advice is invaluable. A CPA will know the deductions you can take and save you money.

CPAs are your business partner

A CPA is your most valuable business partner. The more years you are with this CPA, the more knowledgeable he/she becomes on your business strategy and goals. Your CPA is your business partner and trusted advocate. The business partnership you form with your CPA will last years. If you work with your CPA, remain organized in your record keeping, tax season will not be a stressful time of year.

About Pamela Kay

My name is Pamela Kay. I provide lifestyle and branding photography for busy entrepreneurs, small business owners and unique couples. I book a limited amount of weddings each year.

Let images tell your story. Connect and engage with your people. Create portraiture for your home that will be admired for generations. Contact me today!

Let’s schedule a latte date and discuss images that will be right for your marketing materials or social media or personal needs. Please take a moment to Opt In for updates and Keep Smiling!

No Comments